Mutual funds and Exchange-Traded Funds (ETFs) offer Karachi investors convenient, diverse, and managed ways to enter the market. Mutual funds pool money from multiple sources for a diversified portfolio overseen by professionals, reducing risk compared to direct stock investments. ETFs provide dynamic access to a wide range of assets throughout the trading day, offering flexibility and minimal risk. Both options enable folks in Karachi to grow their wealth through strategic asset allocation and expert management, with ETFs often boasting lower expense ratios. To maximize returns, focus on top-performing funds and industry-specific ETFs for transparency and liquidity in Karachi's vibrant financial scene.

In the vibrant, ever-evolving investment landscape of Karachi, understanding mutual funds and Exchange-Traded Funds (ETFs) is crucial for savvy investors. This comprehensive guide delves into these powerful tools, offering a clear overview tailored for local investors. From unlocking diversification potential with ETFs to highlighting the benefits and navigating fees of mutual funds, this article equips you with the knowledge to make informed decisions. Discover top picks designed to deliver optimal returns in today’s market, making your journey towards best investing smoother than ever.

- Understanding Mutual Funds: An Overview for Karachi Investors

- Exchange-Traded Funds (ETFs): Unlocking Diversification Potential

- The Benefits of Investing in Mutual Funds and ETFs

- Navigating Fees and Expenses: A Key Consideration

- Top Mutual Fund and ETF Picks for Optimal Returns

Understanding Mutual Funds: An Overview for Karachi Investors

Mutual funds offer a convenient and diverse way for Karachi investors to enter the market. These investment vehicles pool money from numerous investors to purchase a diversified portfolio of stocks, bonds, or other securities. A professional fund manager oversees this process, making investment decisions on behalf of the investors. The key advantage lies in instant diversification, allowing individuals to access hard-to-reach assets and reduce risk compared to direct stock investments.

For Karachi investors, mutual funds provide an accessible route to explore various investment options. With numerous local and international fund houses operating in the city, investors can choose from a wide range of funds catering to different risk appetites and investment goals. Understanding the fundamental concepts behind mutual funds is the first step towards making informed investing decisions in the vibrant Karachi market.

Exchange-Traded Funds (ETFs): Unlocking Diversification Potential

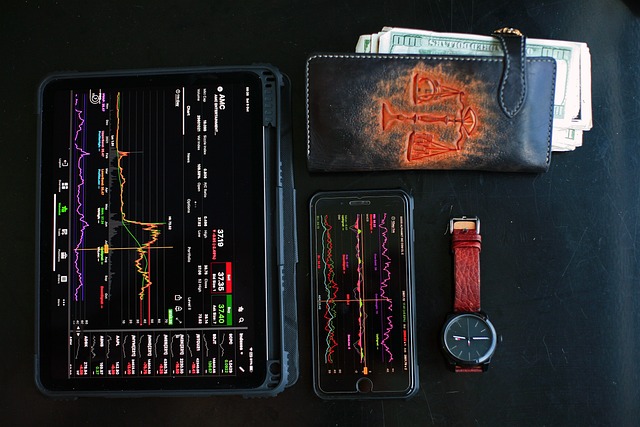

Exchange-Traded Funds (ETFs) have emerged as a powerful tool for investors in Karachi and beyond, offering unparalleled diversification opportunities. Unlike traditional mutual funds that trade in blocks at the end of the day, ETFs are bought and sold on stock exchanges throughout the trading day, just like individual stocks. This feature allows investors to gain exposure to a wide range of assets, including stocks, bonds, commodities, and even entire market indices, within a single transaction.

The best investing strategy in Karachi often involves leveraging ETFs to create a balanced portfolio. By investing in a diverse array of securities, ETFs minimize the risk associated with individual stock picks. This diversification is particularly beneficial for investors who may lack the time or expertise to select individual stocks across various sectors and industries. With ETFs, investors can easily track market performance and adjust their holdings based on changing economic conditions, making them an attractive option for both long-term investors and those seeking short-term gains.

The Benefits of Investing in Mutual Funds and ETFs

Investing in mutual funds and exchange-traded funds (ETFs) offers a wide range of benefits for folks looking to grow their wealth in the best investing opportunities available in Karachi and beyond. One of the key advantages is diversification; these financial instruments allow investors to spread their investments across various assets, sectors, and regions, thereby reducing risk. This strategic approach ensures that even if one investment performs poorly, others may compensate, providing a more stable portfolio.

Furthermore, mutual funds and ETFs are managed by professional fund managers who research and select the best-performing securities, saving investors time and effort. This active management can lead to superior returns over the long term, making them attractive options for those seeking expert guidance in the complex world of investing.

Navigating Fees and Expenses: A Key Consideration

Navigating fees and expenses is a crucial aspect of smart investing in Karachi or any other financial hub. Unlike traditional mutual funds, ETFs (Exchange-Traded Funds) offer an advantage with often lower expense ratios due to their passive management strategy. This can significantly impact your long-term returns, making ETFs an attractive option for the best investing opportunities.

When considering mutual funds, it’s essential to understand the various fees involved, such as management fees, sales charges, and administrative costs. These fees can erode your investment value over time. In contrast, ETFs generally have lower fee structures, allowing investors in Karachi to maximize their returns potential. By carefully evaluating these expenses, savvy investors can make informed decisions and choose the best investing strategies suited to their financial goals.

Top Mutual Fund and ETF Picks for Optimal Returns

When it comes to maximizing returns in your investment journey, Karachi, being a bustling financial hub, offers a plethora of options through mutual funds and ETFs. Among the top picks for both categories are those with consistent track records, managed by reputable asset management companies. For mutual funds, look out for schemes focused on diverse sectors like technology, healthcare, or renewable energy, which have shown promising growth in recent years. These funds provide exposure to a wide range of stocks, mitigating risk through diversification.

ETFs, known for their transparency and liquidity, are another smart choice. Focus on industry-specific ETFs that track indices with strong performance potential. With the right combination of these instruments in your portfolio, you can achieve optimal returns while staying ahead in the dynamic investing landscape of Karachi.

For investors in Karachi looking to diversify their portfolios, mutual funds and ETFs offer a powerful combination of accessibility and potential returns. By understanding the nuances of these investment vehicles, from fee structures to top-performing picks, you can make informed decisions that align with your financial goals. Remember, smart investing is not just about choosing the best options; it’s about knowing where to start and how to navigate this dynamic landscape for optimal results.

Leave a Reply

You must be logged in to post a comment.